Small Value Withholding Tax Payment (update)

Small Value Withholding Tax Payment (update)

IRB released a media release on 27/09/22 in respect of deferment of small value WHT.

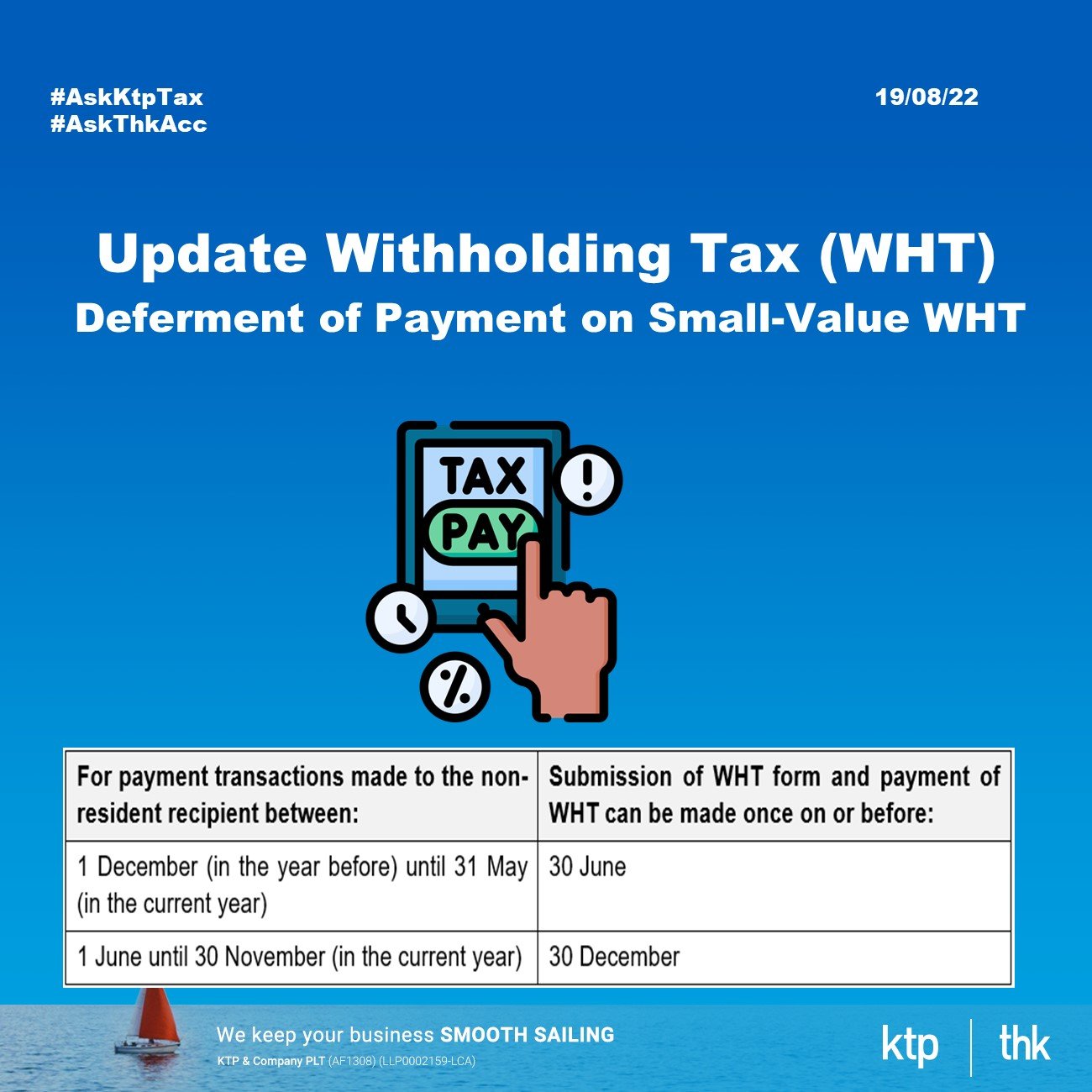

An individual/body resident in Malaysia or doing business in Malaysia that is required to pay WHT under S.109 or S.109B of the Income Tax Act 1967 that do not exceed RM500 per transaction for transactions that recur may submit the WHT form and pay the WHT as follows:

S.109 or S.109B of the Income Tax Act 1967

S.109 = Royalty and Interest earned by non-resident

S.109B = Special class of income under Section 4A of the ITA including service and rental of moveable property

Others Operational Issue

The above will take effect from 1st August 2022.

The WHT form (CP37 & CP37A) and WHT payment of small value for transactions that recur can be submitted once on or before 31 December for payment transactions made to non-residents between 1 June to 30 November in the current year.

Payers are advised to keep a list of recipients in respect of the small value WHT.

Visit Us

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

Website www.ktp.com.my

Instagram https://bit.ly/3jZuZuI

Linkedin https://bit.ly/3sapf4l

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Bookkeeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsourcing bookkeeping, and payroll services to clients

Website www.thks.com.my

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

Tiktok http://bit.ly/3u9LR6Q

Youtube http://bit.ly/3ppmjyE

Facebook http://bit.ly/3ateoMz

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancies in Johor Bahru for interns, graduates & experienced candidates.

Instagram https://bit.ly/3u2PxHg

Facebook http://bit.ly/3rPxz9o