What is Wilful tax evasion ?

What is Wilful tax evasion ?

What is Wilful tax evasion ?

Hello everyone. I am an account executive. Now I am in an SDN bhd in charge full set account.

I would like to ask everyone’s opinion, if the boss asks for false accounting, because the boss don’t want to give too much tax.

I’ve already told the boss that it’s illegal to do so.

If LHDN finds it out, what responsibilities do I have to bear? Will I be fined? Still going to jail?

Two important laws as a reference

Income Tax Act 1967 Section 114 Wilful evasion

Company Act 2016 Section 245 Accounts to be kept

Income Tax Act 1967 Section 114 Wilful evasion

114. (1) Any person who willfully and with intent to evade or assist any other person to evade tax

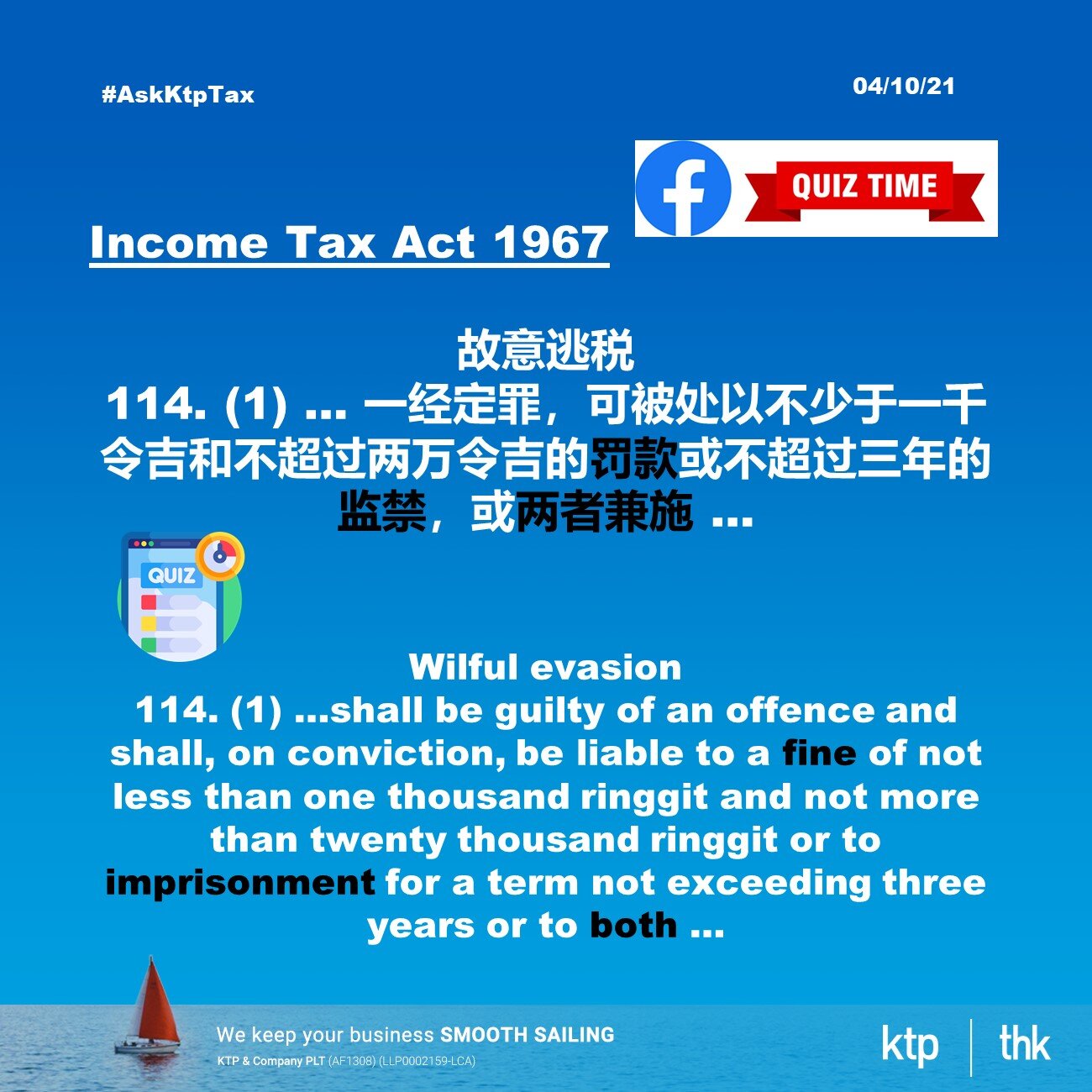

114. (1) (1A) …shall be guilty of an offence and shall, on conviction, be liable to a fine of not less than one thousand ringgit and not more than twenty thousand ringgit or to imprisonment for a term not exceeding three years or to both

114. (1) (1A) Any person who assists in, or advises with respect to, the preparation of any return where the return results in an understatement of the liability for tax of another person shall unless he satisfies the court that the assistance or advice was given with reasonable care be guilty of an offence and shall, on conviction, be liable to a fine of not less than two thousand ringgit and not more than twenty thousand ringgit or to imprisonment for a term not exceeding three years or to both.

Company Act 2016 Section 245 Accounts to be kept

Section 245.(1) A company, the directors and managers of a company shall

(a) cause to be kept the accounting and other records to sufficiently explain the transactions and financial position of the company and enable true and fair profit and loss accounts and balance sheets and any documents required to be attached thereto to be prepared.

Section 245.(9) The company and every officer who contravene this section commit an offence and shall. on conviction be liable to a fine not exceeding five hundred thousand ringgit or to imprisonment for a term not exceeding three years or to both.

Manager, in relation to a company, means the principal executive officer of the company for the time being by whatever name called and whether or not he is a director.

Visit Us

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

Website www.ktp.com.my

Instagram https://bit.ly/3jZuZuI

Linkedin https://bit.ly/3sapf4l

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

Website www.thks.com.my

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

Tiktok http://bit.ly/3u9LR6Q

Youtube http://bit.ly/3ppmjyE

Facebook http://bit.ly/3ateoMz

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

Instagram https://bit.ly/3u2PxHg

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Archive

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- November 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016