[TAX UPDATE] Withholding Tax Payment via MyTax Portal

[TAX UPDATE] Withholding Tax Payment via MyTax Portal

Withholding tax is essentially a means of collecting tax at source from the payer of the income rather than raising an assessment on the actual recipient. The tax that is withheld is then paid over to the tax authorities of the source country.

Starting from 1 April 2022, LHDN has launched an online payment system e-TT for users to make tax payments. e-TT is a system that uses Virtual Account Number (VA) as payment identification.

Tax payers who want to access the e-TT system can get their VA by following these steps:

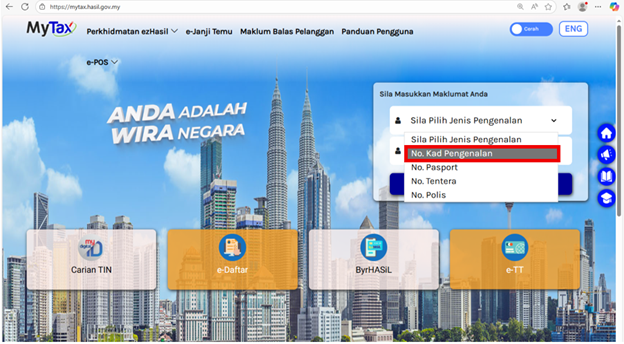

Step 1: Log in to the MyTax portal at http://mytax.hasil.gov.my

Step 2: Select the ID type and enter your ID number.

Step 3: Enter your password and click “Log Masuk”.

Step 4: Log in to MyTax, and the dashboard will show.

Step 5: Please select the “Perkhidmatan ezHasil” select e-WHT.

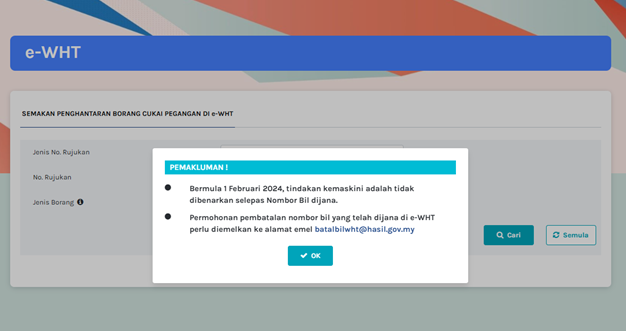

Please take note, if you cancel the bill number from e-WHT, you need to email the LHDN officer as follows:-

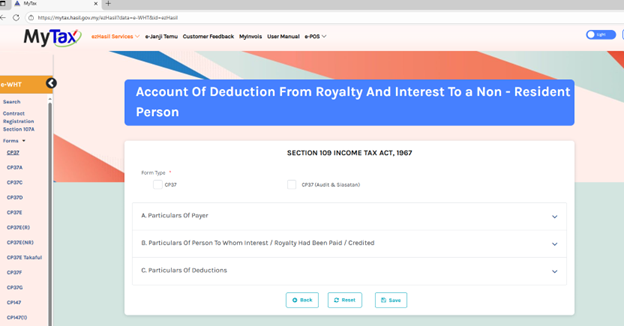

Step 6: Navigate to the e-WHT panel, and select the Type of withholding form.

Step 6.1: Fill in the relevant information withholding tax – Royalty.

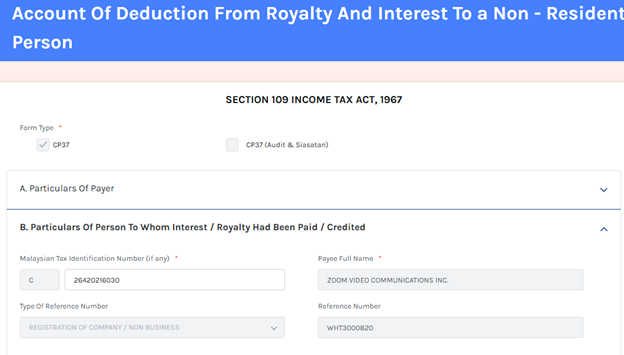

(For illustration purposes only.)

Step 6.2: For the CP37, click on the relevant form type as shown in the dashboard (e.g., CP37 for standard submission or CP37 Audit & Siasatan if applicable).

Step 6.3: Enter the particulars of the payer (e.g., the income tax number) and check the accuracy of the display information.

Step 6.4: Enter the particulars of the person to whom the royalty has been paid or credited.

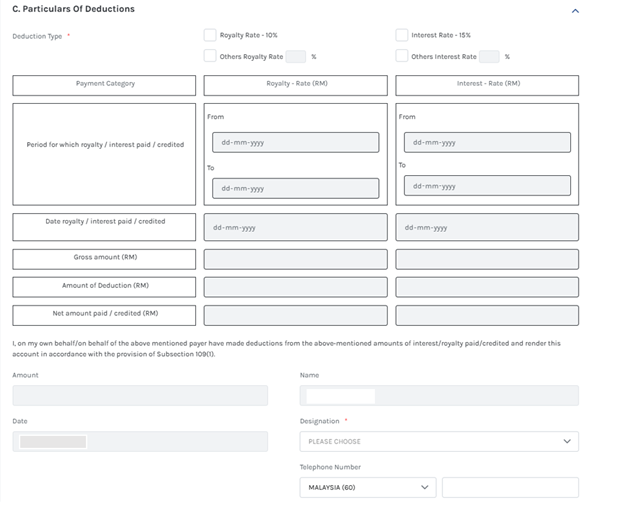

Step 6.5: Fill in the Particulars of Deduction

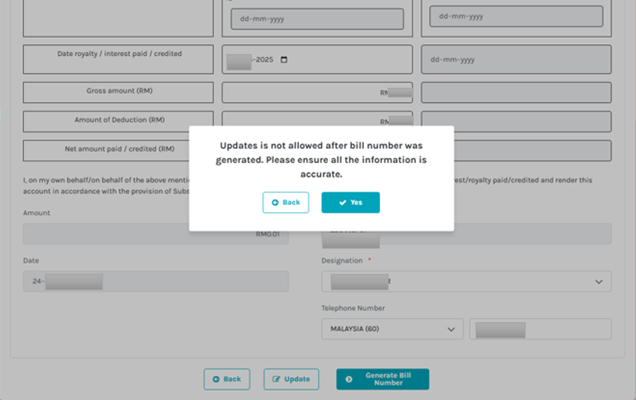

Step 6.6: After fill in the information, please click “Save” and “Generate Bill Number”.

Important: Once the bill number is generated, further updates are not permitted.

Step 6.7: The bill number will be generated and select the payment channel, either via ByrHasil or Kaunter Bayaran LHDNM.

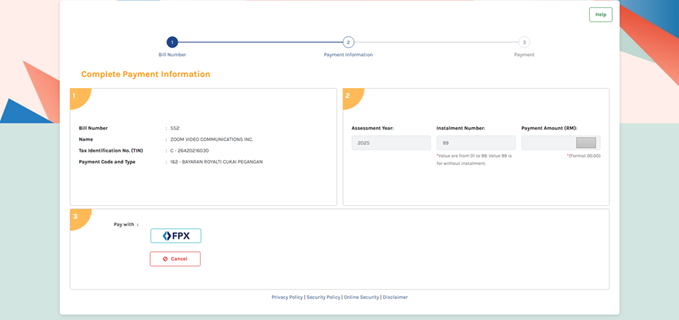

Step 6.8: If you choose payment via ByrHasil, the dashboard will be displayed as shown in the attachment. Ensure the information is correct, then click the “FPX” button.

Important note:

Withholding tax payments can be made through the following methods:

Manual payment [only bank drafts are accepted at the Payment Counter of the Revenue Management Centre (RMC)]

Online payment via e-services (e-TT and e-WHT)

All withholding tax payments must be accompanied by a generated bill number to facilitate the issuance of a receipt.

Payment forms and supporting documents do not need to be submitted to IRBM. These documents should be consistently retained and submitted to IRBM immediately if required.

How to download the LHDN receipt

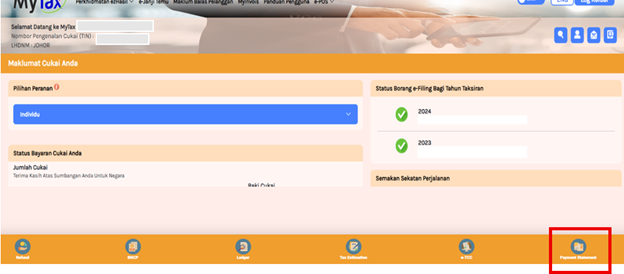

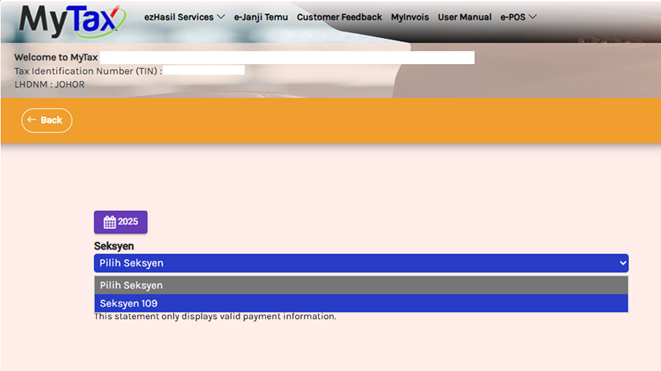

Step 1: After the payment is completed, return to the dashboard and click the “Payment Statement” button.

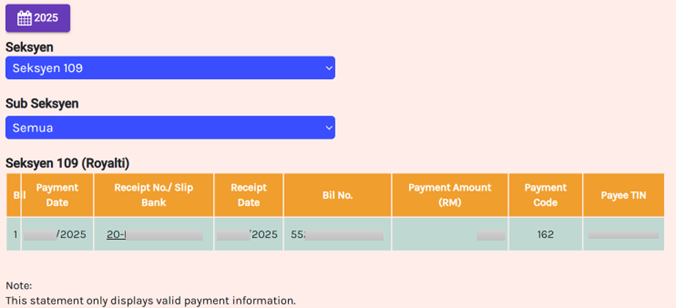

Step 2: Please select “Seksyen 109” to view the payment status of the withholding tax.

Step 3: Click on the “Receipt No” to view the withholding tax receipt, which can then be downloaded for your records.

Visit Us

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

Website www.ktp.com.my

Instagram https://bit.ly/3jZuZuI

Linkedin https://bit.ly/3sapf4l

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Bookkeeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsourcing bookkeeping, and payroll services to clients

Website www.thks.com.my

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

Tiktok http://bit.ly/3u9LR6Q

Youtube http://bit.ly/3ppmjyE

Facebook http://bit.ly/3ateoMz

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancies in Johor Bahru for interns, graduates & experienced candidates.

Instagram https://bit.ly/3u2PxHg

Facebook http://bit.ly/3rPxz9o