What records that are to be kept or retained for the purpose of income tax?

Read MoreDo you know law is not law until the law is gazetted?

Read MoreThere are two core methods to buy or sell a business: an asset purchase or a share purchase. An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.

Read MoreEffective 01 January 2020, provision of digital service from foreign service provider (FSP) to consumer in Malaysia is subject to service tax.

Read MoreNo more tax payment via post/courier….

Read MoreLeave passage refers to vacation time paid for by your employer, and is divided into two categories: local and overseas. You are entitled to tax exemption not exceeding three times in a year for leave passage within Malaysia, and one leave passage outside Malaysia not exceeding RM3,000

Read MoreInternational tax issues due to COVID-19 travel restrictions

Read MoreThe complete tax ruling on company insurance tax deductible in Malaysia

Read More汽车福利的计算法已计算个人福利在内(意即税务计算法已经很低),而且该辆车可被开回家当作个人用途,形同个人福利,所以这是需要申报的(连带也要给每月预扣税)。

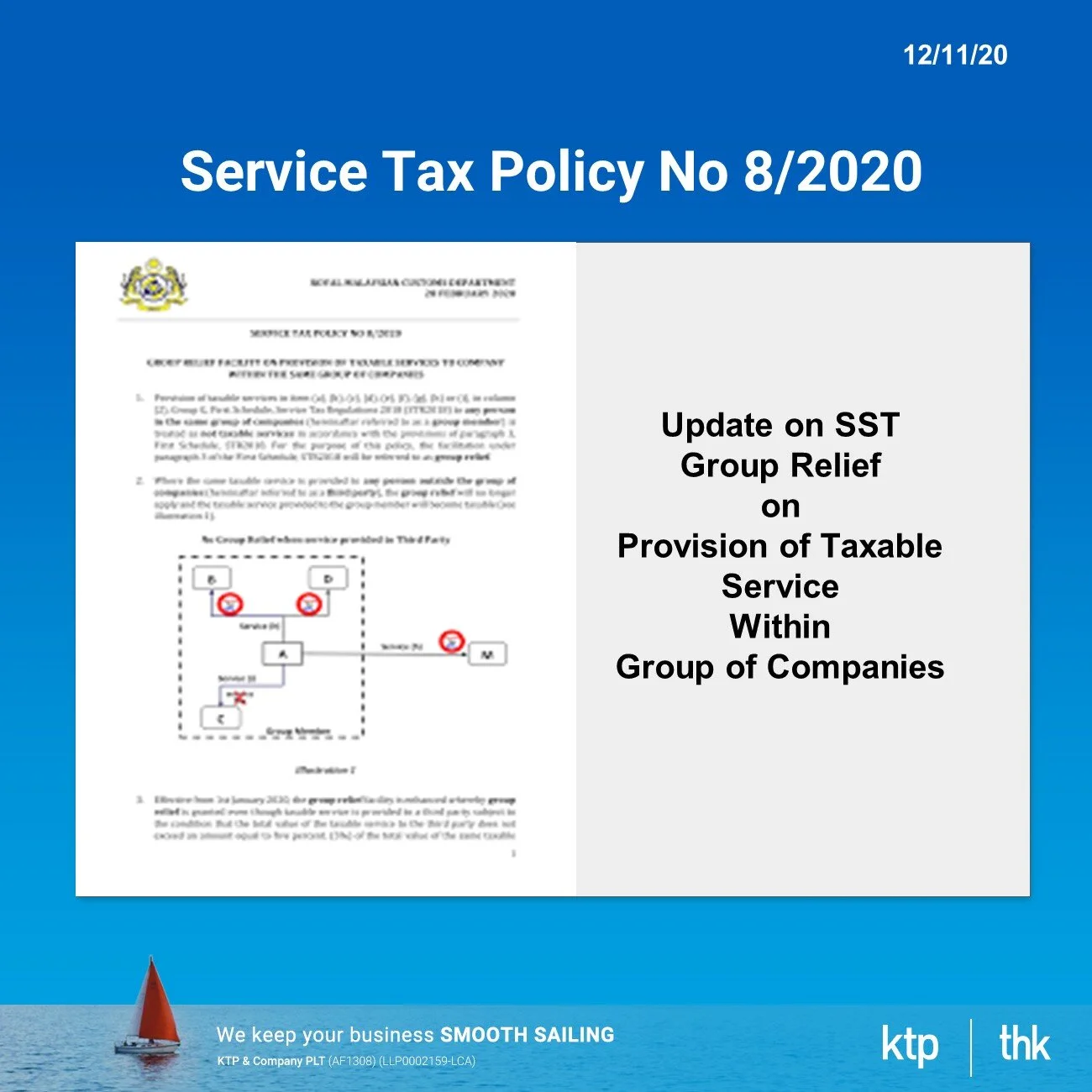

Read MoreRMC Service Tax Policy 8/2020 - changes in the condition of group relief on provision of taxable service within group of companies

Read MoreSee you in court if taxpayers don’t response to CP323F

Read More我等到花儿也谢了….创业有钱拿但拿不到!!!!

Read MoreMalaysia car income tax 2020.

Read MoreYou can donate more for tax deduction now

Read MoreAny tax deduction on my passenger car?

Read More

车可以扣税?

Read More

Directors are also responsible for the companies' tax obligation under the Malaysian Income Tax Act (ITA) 1967. ... He or she is not treated as a distinct legal person from the company, and thus can be personally liable in the case of tax obligations.

5 out 10 your account people don't know how to do foreign exchange gain and loss based on our 20 years experience in accounting industry! Now, IRB has produce an official guideline to clear your doubt.

The Malaysian Transfer Pricing Guidelines explain the provision of Section 140A in the Income Tax Act 1967 and the Transfer Pricing Rules.

Read MoreWhat is the latest change on tax deduction for tax and secretarial fee from IRB guidelines?