SSM forms for Sdn Bhd

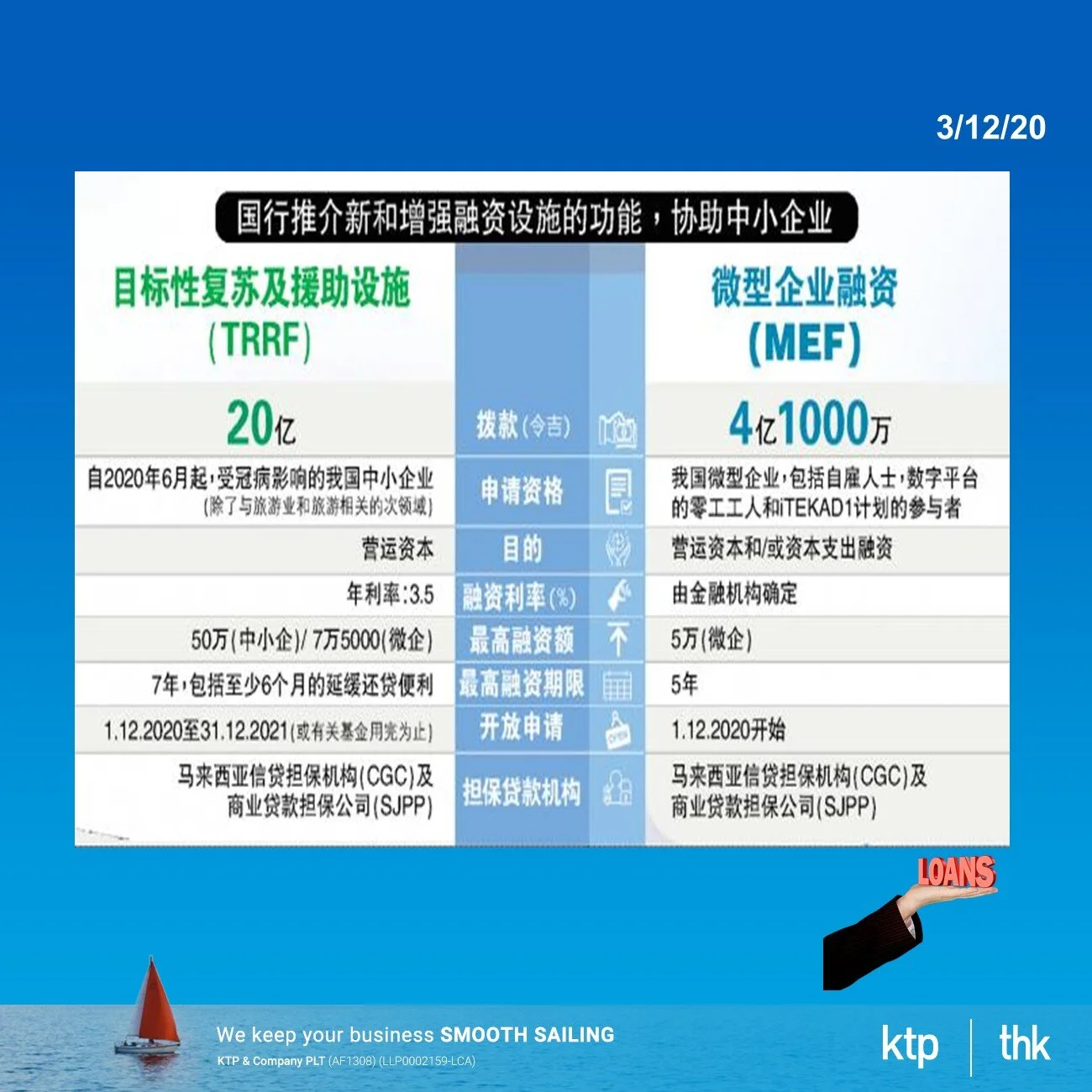

Read More国家银行宣布,2021年财政预算案提及的2项基金,即目标性复苏及援助设施(TRRF)及微型企业融资(MEF),现今开放让受

Read MoreMalaysia have introduced measures to identify individual persons ... another company, to disclose the REAL BOSS BEHIND THE CURTAIN

Read MorePractical Tax Saving Tips is to Maximise Tax Relief Available

Read MoreWhat records that are to be kept or retained for the purpose of income tax?

Read MoreDo you know law is not law until the law is gazetted?

Read MoreThere are two core methods to buy or sell a business: an asset purchase or a share purchase. An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.

Read MoreEffective 01 January 2020, provision of digital service from foreign service provider (FSP) to consumer in Malaysia is subject to service tax.

Read MoreNo more tax payment via post/courier….

Read MoreLeave passage refers to vacation time paid for by your employer, and is divided into two categories: local and overseas. You are entitled to tax exemption not exceeding three times in a year for leave passage within Malaysia, and one leave passage outside Malaysia not exceeding RM3,000

Read MoreInternational tax issues due to COVID-19 travel restrictions

Read MoreFinance Bill Section 6D 有限公司或有限合伙企业的回扣 RM20,000 x 3

Read MoreFinance Bill Section 6D explain tax rebate for company & LLP

Read More雇员公积金局今日公布“i-Sinar第一户头提款计划”详情,第一户头存款9万令吉及以下的合格会员,最高可提取9000令吉;存款…

Read MoreThe complete tax ruling on company insurance tax deductible in Malaysia

Read More汽车福利的计算法已计算个人福利在内(意即税务计算法已经很低),而且该辆车可被开回家当作个人用途,形同个人福利,所以这是需要申报的(连带也要给每月预扣税)。

Read More