SSM Enforcement Unit is to raise the corporate compliance rate by encouraging good corporate governance values through a continuous education program as well as via effective surveillance and enforcement efforts

Directors are also responsible for the companies' tax obligation under the Malaysian Income Tax Act (ITA) 1967. ... He or she is not treated as a distinct legal person from the company, and thus can be personally liable in the case of tax obligations.

5 out 10 your account people don't know how to do foreign exchange gain and loss based on our 20 years experience in accounting industry! Now, IRB has produce an official guideline to clear your doubt.

The Malaysian Transfer Pricing Guidelines explain the provision of Section 140A in the Income Tax Act 1967 and the Transfer Pricing Rules.

Read MoreThis initiative will make the internship experience for Malaysian undergraduates and TVET talents relevant to the industries and thus making them more employable to fill in the current talent shortage in corporate Malaysia especially in companies under NKEA sectors.

Read MoreWhat is the latest change on tax deduction for tax and secretarial fee from IRB guidelines?

Tax treatment on repair cost under public ruling 6/2019?

Tax incentive available to taxpay to save tax legally.

Read MoreSSM Strike Off under S550 Company Act 2016

Read MoreSSM offer 90% Compound Reduction for Strike-Off

Read More审计报告的意见类型共有4种基本类型,但也有时也会根据情况附带强调段和其他事项段

Read MoreAuditor keep asking me about my long outstanding supplier,

My supplier also didn’t ask for payment. So annoying!

Read More使用mydata鉴别冒充大马公司委员会(SSM)网站!

Read More什么是预扣税? 预扣税是由马来西亚内陆税收局(简称:“内陆税收局”)所提出的税收机制,并规定在马. 来西亚境内的付款人应在支付非纳税居民某特定性质款项…

Read More什么是预扣税? 预扣税是由马来西亚内陆税收局(简称:“内陆税收局”)所提出的税收机制,并规定在马. 来西亚境内的付款人应在支付非纳税居民某特定性质款项…

Read More什么是预扣税? 预扣税是由马来西亚内陆税收局(简称:“内陆税收局”)所提出的税收机制,并规定在马. 来西亚境内的付款人应在支付非纳税居民某特定性质款项…

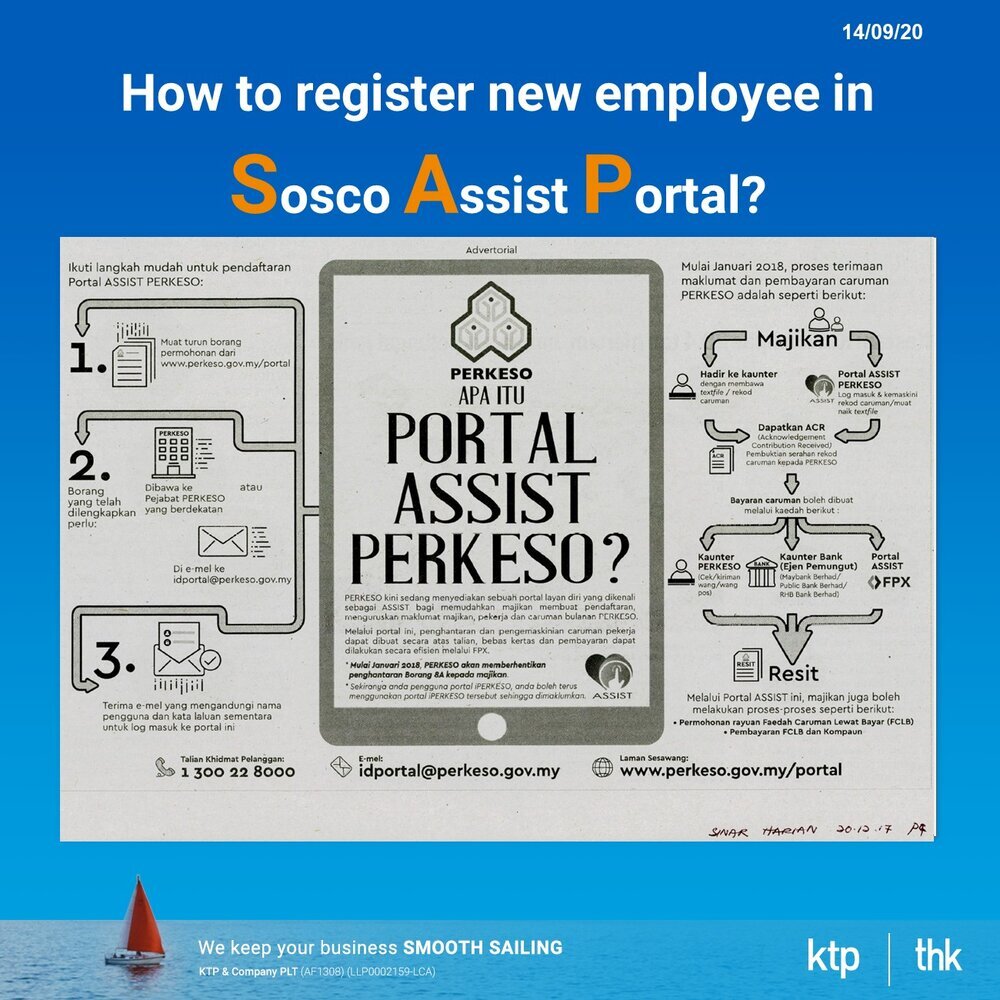

Read MoreGuide on Sosco Assist Portal

Read MoreOn 27.08.2020, Minister of Human Resources had issued a Federal Government Gazetted on Employees’ Minimum Standards of Housing, Accommodations and Amenities (Accommodation and Centralized accommodation regulations 2020)

Do you have doubts on the impact of tax residence from COVID-19 travel restrictions?

Read MoreBeneficial ownership refers to individuals who invest in, control, or reap gains from an asset, such as a bank account, real estate, company, or trust, but who are not listed publicly as legal owners.

SSM said companies which fail to reveal their owners are liable to a compound fine of up to RM50,000.

Read More