Leave passage refers to vacation time paid for by your employer, and is divided into two categories: local and overseas. You are entitled to tax exemption not exceeding three times in a year for leave passage within Malaysia, and one leave passage outside Malaysia not exceeding RM3,000

Read MoreInternational tax issues due to COVID-19 travel restrictions

Read MoreFinance Bill Section 6D 有限公司或有限合伙企业的回扣 RM20,000 x 3

Read MoreFinance Bill Section 6D explain tax rebate for company & LLP

Read More雇员公积金局今日公布“i-Sinar第一户头提款计划”详情,第一户头存款9万令吉及以下的合格会员,最高可提取9000令吉;存款…

Read MoreThe complete tax ruling on company insurance tax deductible in Malaysia

Read More汽车福利的计算法已计算个人福利在内(意即税务计算法已经很低),而且该辆车可被开回家当作个人用途,形同个人福利,所以这是需要申报的(连带也要给每月预扣税)。

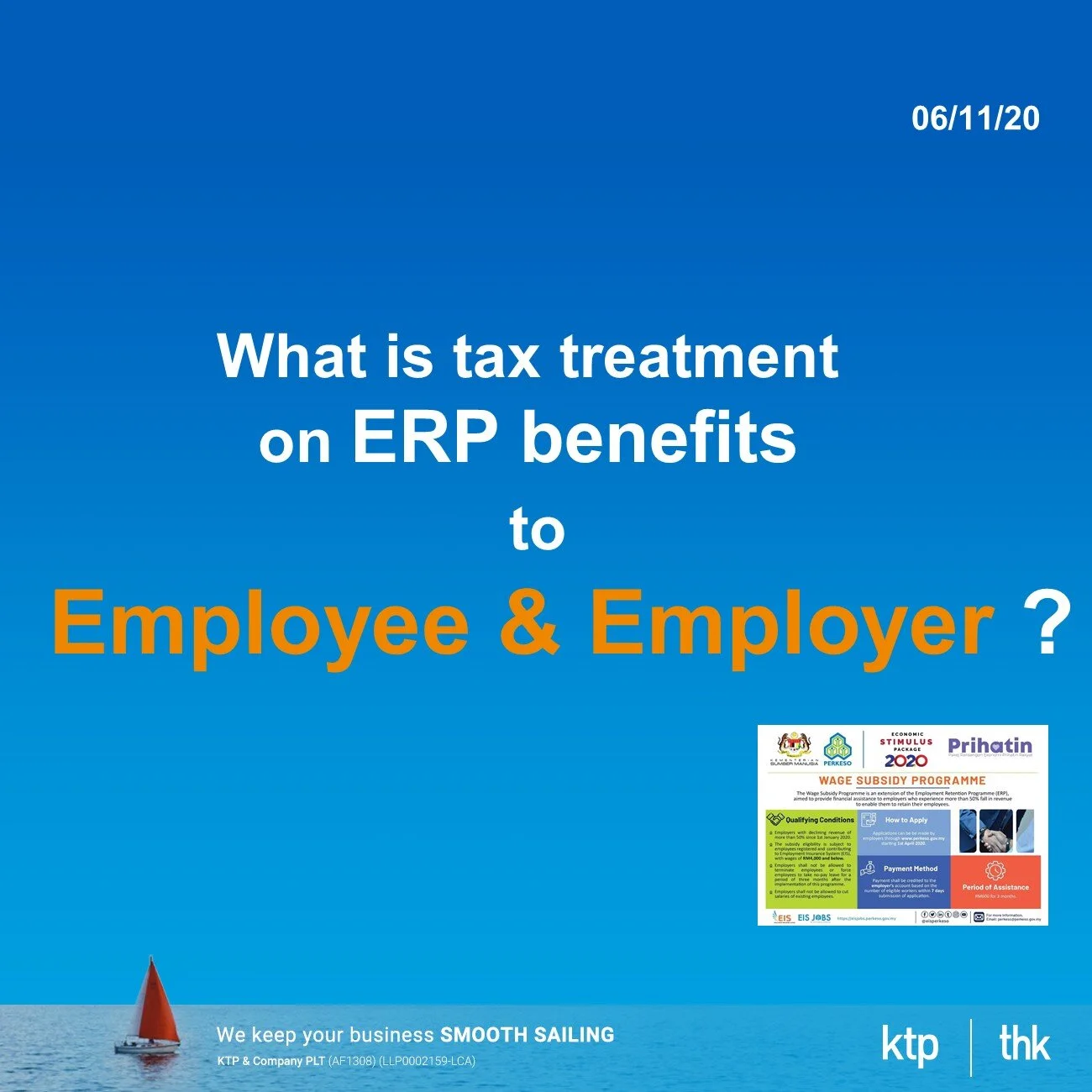

Read MoreThe Wage Subsidy Programme 2.0, this updated initiative – introduced as part of the new KITA PRIHATIN Package is to….

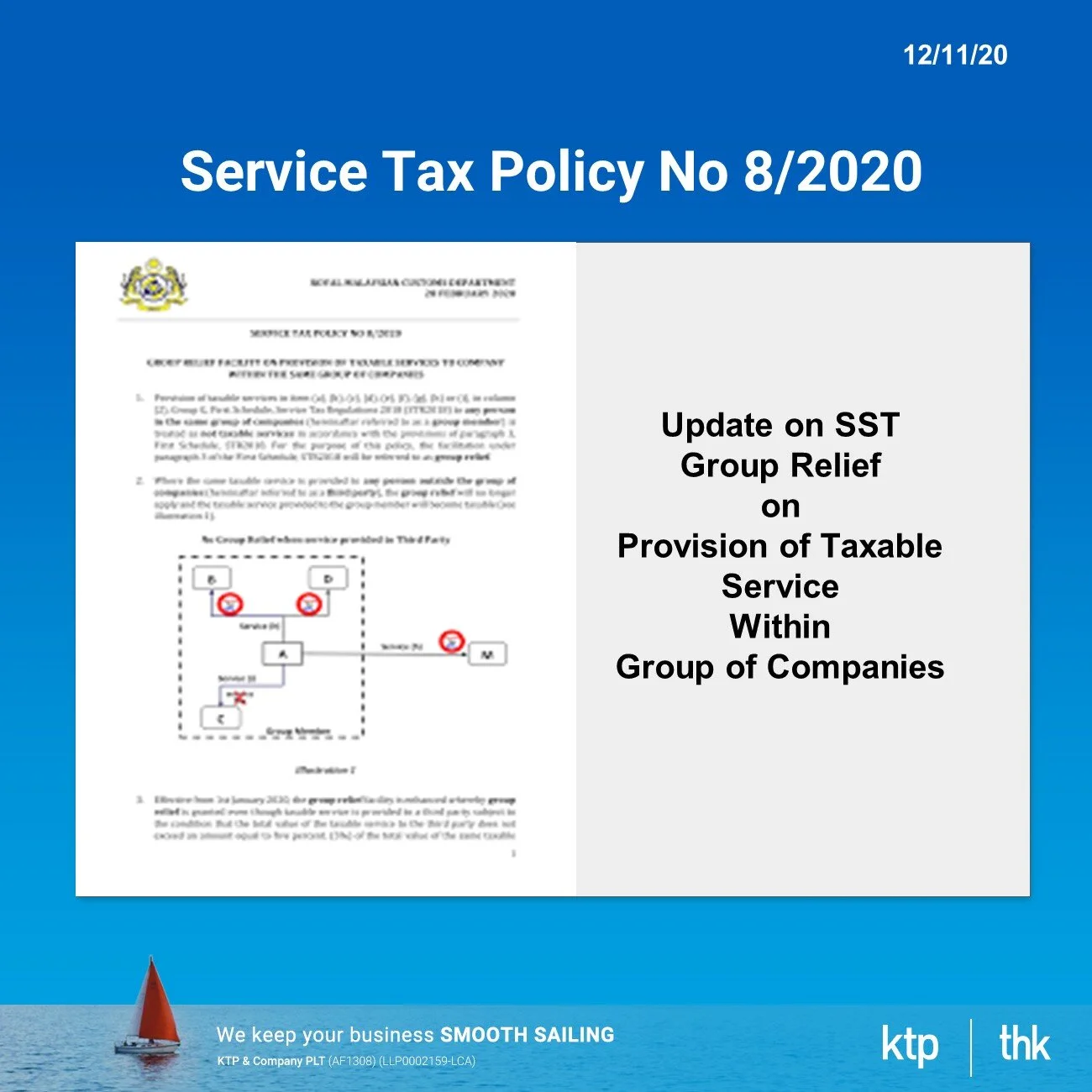

Read MoreRMC Service Tax Policy 8/2020 - changes in the condition of group relief on provision of taxable service within group of companies

Read MoreSee you in court if taxpayers don’t response to CP323F

Read More我等到花儿也谢了….创业有钱拿但拿不到!!!!

Read MoreMalaysia car income tax 2020.

Read MoreIs it taxable income on the government subsidy to workers during MCO?

Read More

You can donate more for tax deduction now

Read More《马来西亚劳工法令》终极秘籍

Read More

Any tax deduction on my passenger car?

Read More

最近很多公司在进行裁员很多朋友关心到底裁员赔偿金怎么算?多少个月才算合法?

Read More

车可以扣税?

Read More

年度报表123

Read More

SSM publish a media release to caution directors on failure to kept accounting records for 7 years.